SurePay - SME Platform

SurePay is a Saudi Arabia-based platform designed to assist small and medium-

sized enterprises (SMEs) in managing their finances, checking loan eligibility, and

applying for loans. The goal of this project was to create a seamless and intuitive

platform for small businesses to navigate the complexities of financial

management and secure funding.

- ✦ UI/UX Design

- ✦ Icon Design

- ✦ Design System

Challenge

Small businesses often face difficulties in understanding financial products and navigating the loan application process. SurePay aimed to simplify these processes and provide businesses with an easy-to-use platform that not only helps assess loan eligibility but also offers tools to manage and track their finances.

Design & Solution:

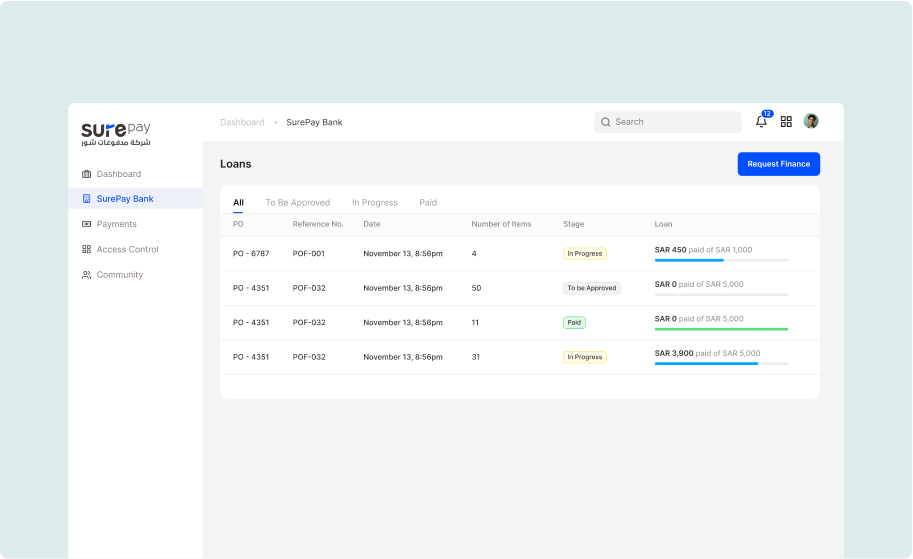

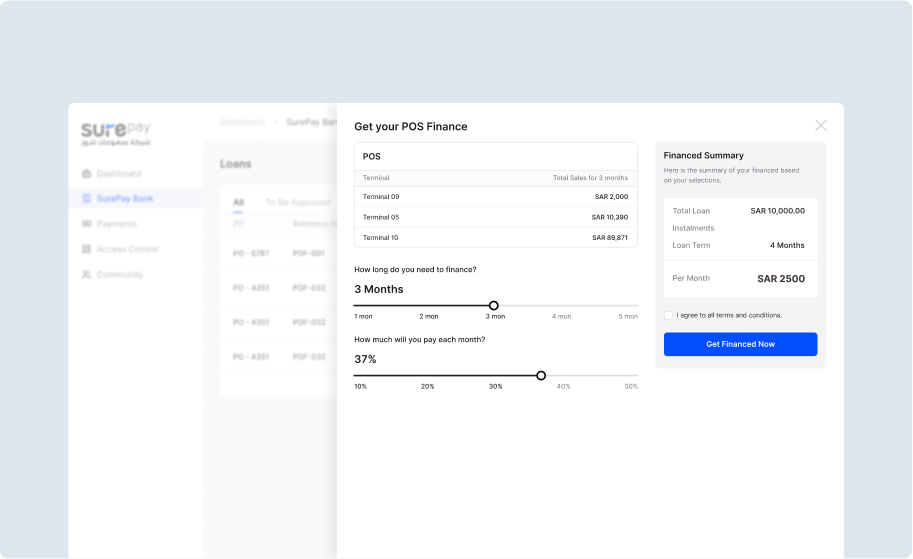

Streamlined Loan Eligibility Checker:I designed an easy-to-use loan eligibility checker that guides users through a simple questionnaire, instantly providing feedback on their eligibility. This tool eliminates the confusion often associated with financial assessments.

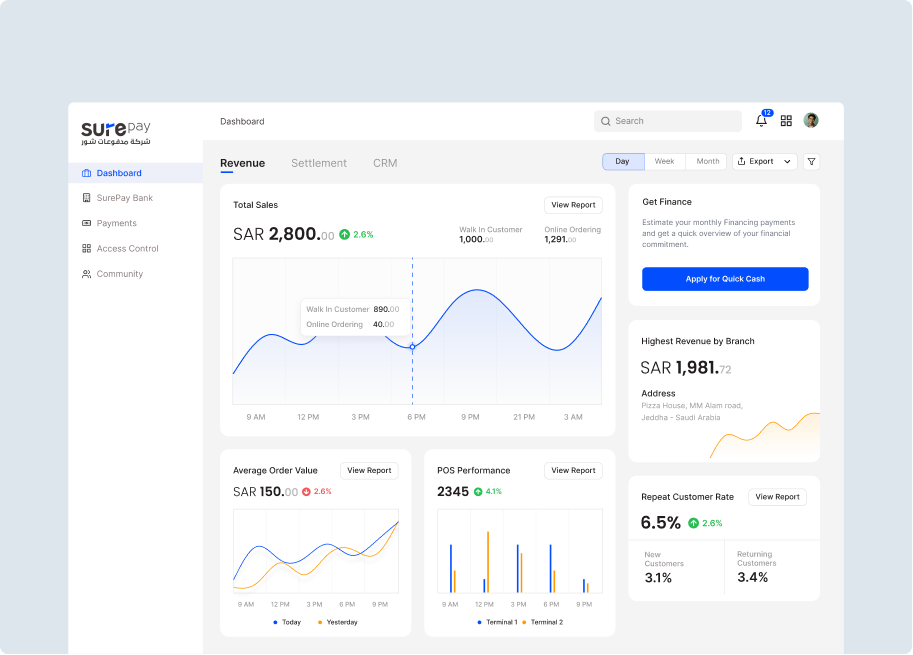

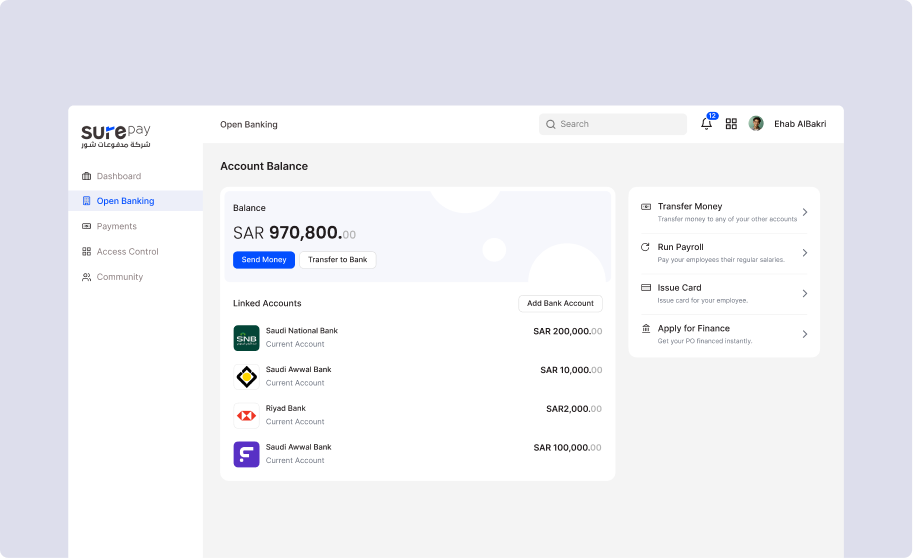

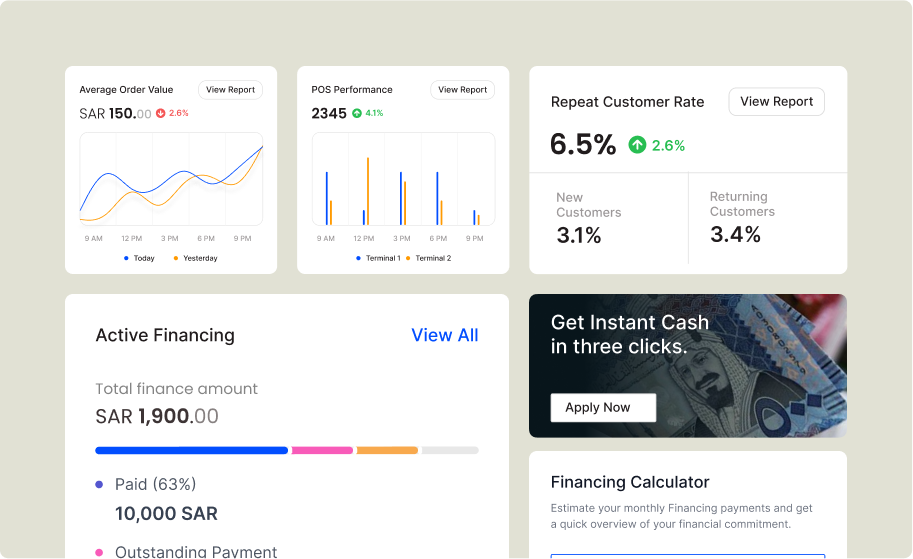

Financial Management Dashboard:I created a personalized dashboard where users could view their financial health, track expenses, and set financial goals. The interface was designed to be clear and straightforward, even for users with limited financial knowledge.

Simplified Loan Application Process:I mapped out a step-by-step loan application flow that is easy to follow, with clear instructions at each stage. This process was designed to minimize friction and make applying for a loan as seamless as possible.

Local Language & Customization:Given the target market in Saudi Arabia, I ensured the platform supported both Arabic and English, providing a localized experience that reflected the cultural and business environment.

Results

Improved User Engagement:The simplified loan eligzibility checker and financial tools led to a 40% increase in active users within the first three months after launch.

Faster Loan Applications:The streamlined loan application process reduced the average time to apply by 50%, resulting in quicker loan approvals and higher customer satisfaction.

Positive User Feedback:Users reported that SurePay made managing their business finances and applying for loans much more transparent and less intimidating. The platform’s ease of use and accessibility were highlighted as key factors in its success.